Butuuro rebrands to Butuuro Financial Services

Butuuro Sacco located in Nyakabirizi division, Bushenyi-ishaka municipality has rebranded from Butuuro Sacco to Butuuro Financial Services.

The new development that was launched during the weekend is a step towards achieving their vision of turning into a Microfinance Deposit taking Institution, a journey that started in 2020 at the peak of the Covid induced lockdown which saw many institutions break down

By becoming an MDI, Butuuro will join a list of MDIs including EFC Uganda, FINCA Uganda, UGAFODE Microfinance Limited and Pride Microfinance Limited controlled by the Deposit Protection Fund of Uganda (DPF), a government agency that provides deposit insurance to customers of deposit-taking institutions licensed by Bank of Uganda.

By this, the institution bears a purpose of providing better social and financial solutions to both local and international clients.

In the Ugandan context, an MDI means a company licensed to carry on, conduct, engage in or transact microfinance business in Uganda.

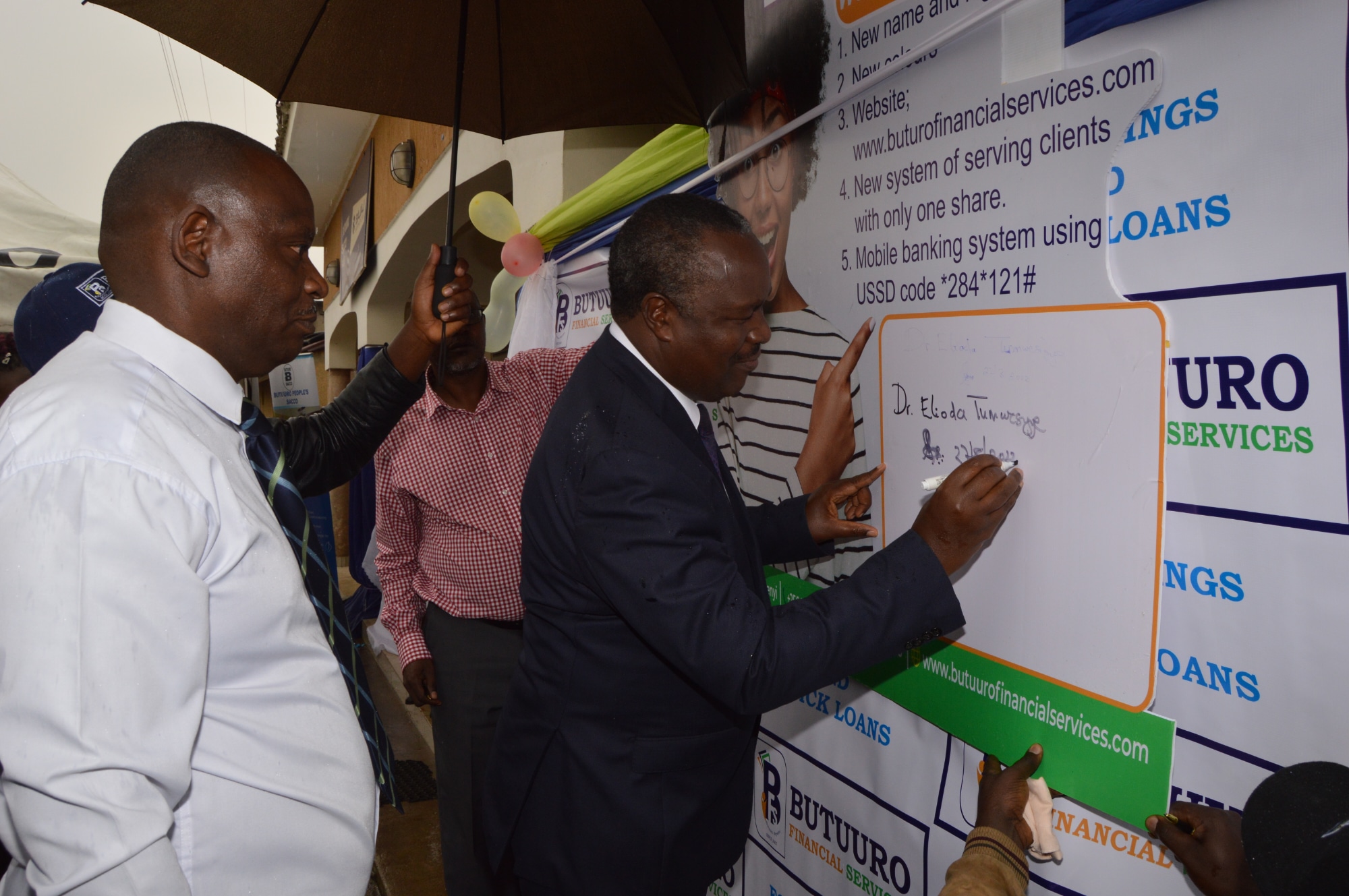

Guest of Honour Dr. Elioda Tumwesigye unveiling new BFS Logo

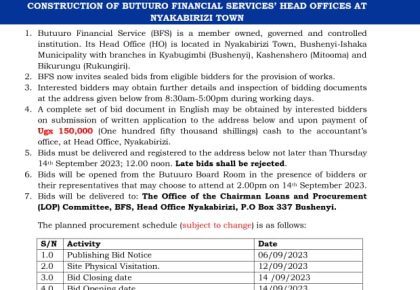

Butuuro’s rebranding arrives with a new name, colors, website, new system of serving clients with one share, mobile banking, etc according to Mr. Peter Tumuhimbise, the institution’s General Manager.

“Changing the logo gives us a new face in the community but with a core objective of reaching all people in communities,” he says

Rebranding will see opening account fees slashed from 47000 to 25000 Uganda shillings which caters for membership of 10000, one share (10,000) and 5000 for stationary. This qualifies clients to get any loan as long as they have the capacity to repay.

The institution that currently has four branches aims to cover the whole of Southwestern Uganda in the next three years according to the leadership.

At the moment, Butuuro legally remains a Sacco but trading as Butuuro financial services. The five-year journey to becoming an MDI started in 2020 and now in the second year, says Mr Pison Mugizi, the institution’s patron.

“We have tried to preempt the requirements of becoming an MDI and after five years, we shall determine whether we remain a Sacco or become an MDI. We recently employed a consultant to conduct a health check and see where we have gaps. We want to fill these gaps and in five years, we want to see where we shall be and this will inform our decision,” Mr Mugizi explains

Butuuro SACCO started operations in 2007 with just one million Ugandan shillings and was duly registered by the Ministry of Trade, Industry and Co-operatives on 15th November 2007 with Registration Certificate CR8583.

Among the requirements for becoming an MDI is having a share capital of ten billion.